Taxes are one of such unavoidable aspects of life, but, the good news is that you could even get part of that money back. In the United States and the United Kingdom, millions of taxpayers have been overpaying taxes annually, and refunds end up being repaid to them.

As an employee, freelancer, or international worker, the ability to compute your refund properly is the main factor to not leaving money on the table.

Fortunately, they can be easily and transparently done with the help of such tools as taxrefund.pro. The platform enables people to estimate their refunds, budget their finances, and prevent the most frequent filing mistakes by having intelligent online calculators that are specific to the region to which the individual belongs.

We will discuss the way tax refunds work, how to use a tax refund calculator to find or how to use a tax refund calculator to find in this comprehensive guide, and how to maximize your refund no matter your place of residence.

- What Is a Tax Refund?

Tax refund refers to the sum of cash that the government refunds you when you have paid more tax than you actually owe within the given financial year.

It is basically a matchmaking process - a manner to offset the difference between the total amount of tax due and amounts that have been paid to date by way of payroll deductions or estimated payments.

In the UK and the US, refunds may take place because of a number of reasons:

- Over-withholding by your employer

- Tax credits or deductions you qualify for

- Changes in income level

- Childcare, education, or work-related expenses

- Charitable donations

Getting a refund isn’t just luck — it’s about understanding how the system works and leveraging available tools.

- Why Use an Online Tax Refund Calculator?

Traditionally, calculating your refund involved complicated math, endless forms, and reading through tax codes. An online calculator simplifies this by automating everything.

Platforms like taxrefund.pro are designed to:

- Estimate your potential refund in minutes

- Factor in all your earnings, deductions, and tax brackets

- Offer tailored tools for both US and UK taxpayers

- Help you plan future withholdings to reduce overpayment

Whether you’re filing in California or Cambridge, using an online calculator saves time and prevents human error.

- How the US Tax Refund System Works

In the United States, the IRS collects income taxes through the “pay-as-you-earn” system — meaning your employer withholds tax from your paycheck each pay period.

Key Components Affecting Your Refund

- Income Tax Bracket:

The US has a progressive tax system — higher earnings are taxed at higher rates. - Tax Withholding:

Your employer uses your W-4 form to determine how much tax to withhold. - Credits and Deductions:

These can significantly reduce your tax liability. Common ones include: - Earned Income Tax Credit (EITC)

- Child Tax Credit

- Student loan interest deduction

- Medical expenses and mortgage interest

- Earned Income Tax Credit (EITC)

- Filing Status:

Whether you file as single, married, or head of household changes your refund outcome.

By entering this data into the US tax refund calculator, users can instantly see their estimated refund amount — no math, no confusion.

- Step-by-Step Guide to Using the US Tax Refund Calculator

- Go to the calculator page:

Visit taxrefund.pro. - Enter your income:

Include all wages, freelance income, and side jobs. - Add deductions:

Input eligible deductions like student loans, 401(k) contributions, or charitable donations. - Include dependents:

If you have children or dependents, the system will automatically apply credits. - View results:

Within seconds, the calculator will show an estimated refund or amount owed.

This tool is updated annually to reflect IRS rate changes, ensuring your estimate is always accurate.

- The UK Tax Refund System Explained

In the United Kingdom, tax is collected through the PAYE (Pay As You Earn) system, managed by HM Revenue & Customs (HMRC). Like the US system, employers deduct income tax and National Insurance directly from your salary.

However, many UK employees overpay — especially those who:

- Change jobs during the tax year

- Work part-time or multiple jobs

- Claim business expenses or uniform costs

- Go on unpaid leave

A refund is issued when HMRC identifies an overpayment or when you file for one through the Self Assessment process.

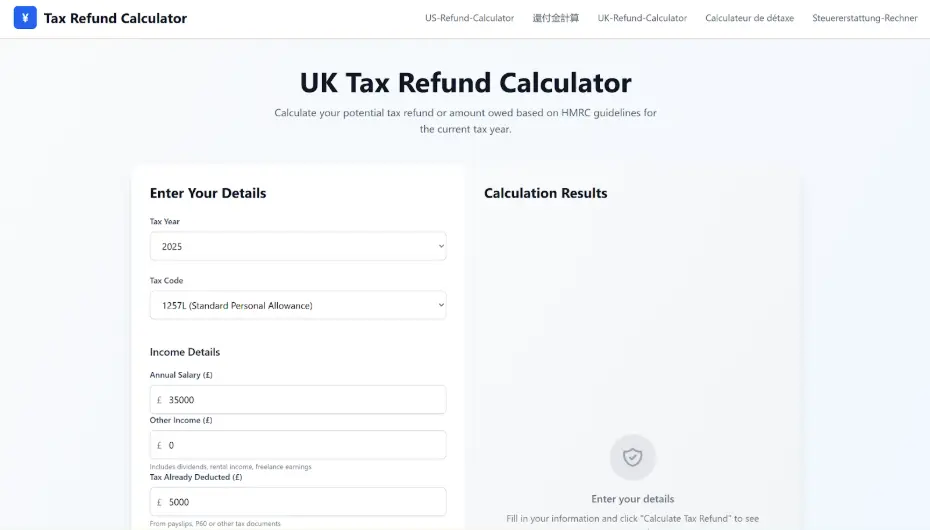

- How to Use the UK Tax Refund Calculator

For British taxpayers, taxrefund.pro offers a dedicated UK tax refund calculator that mirrors HMRC standards.

Steps to Estimate Your UK Refund:

- Select the correct tax year:

The UK tax year runs from 6 April to 5 April. - Enter your gross income:

Include your salary before tax. - Add tax paid:

Use information from your P60 or P45 form. - Include eligible expenses:

Such as uniform cleaning, mileage, or professional fees. - Review results:

Get an instant refund estimate, showing how much HMRC owes you.

This tool helps users understand how changes in tax codes or personal allowances affect their net take-home pay.

- Common Reasons for Tax Refund Delays

Even after filing correctly, refunds can be delayed due to:

- Incorrect bank information

- Missing documents or mismatched employer data

- Filing too early before all income forms arrive

- Random audits or manual reviews

To prevent delays:

- Always double-check your entries

- File electronically for faster processing

- Keep copies of all documents

- How to Maximize Your Tax Refund (Pro Tips)

Here are several proven strategies to boost your tax refund:

- Track deductions year-round:

Don’t wait until filing season — track mileage, medical bills, and donations throughout the year. - Claim education and family credits:

Parents and students often miss valuable credits. - Contribute to retirement accounts:

401(k) and IRA contributions lower taxable income. - Use professional tools like taxrefund.pro:

An accurate refund estimate can guide your financial strategy. - Update your W-4 or tax code:

Prevent overpayment by adjusting withholdings mid-year. - Understanding Tax Brackets and Refund Impact

Your tax bracket directly influences your refund amount. Both the US and UK adjust these brackets annually based on inflation and government policies.

For instance:

- Moving from one bracket to another can reduce your refund.

- Adding deductions or dependents might shift you to a lower bracket.

- Filing jointly can create tax advantages.

The calculators at taxrefund.pro automatically consider these factors to give the most realistic estimate.

- Freelancers, Remote Workers, and Expats

If you work remotely or freelance, your tax situation becomes more complex. Many end up overpaying or missing deductions they could claim.

For US Freelancers:

You may be eligible for:

- Home office deduction

- Business mileage deduction

- Self-employment tax credits

For UK Freelancers:

- Claim simplified expenses for home use and travel

- Deduct software, equipment, and professional insurance

The calculators at taxrefund.pro can help both freelancers and expats estimate what they’re owed with precision.

- The Role of Tax Refund Calculators in Financial Planning

Tax refunds aren’t just extra cash — they’re part of your overall financial strategy.

Using the US tax refund calculator or UK tax refund calculator can help you:

- Plan budgets more effectively

- Identify opportunities for savings

- Adjust your payroll deductions for future balance

- Forecast your take-home pay

In short, taxrefund.pro isn’t just a tool for refunds — it’s a smart step toward financial control.

- Security and Accuracy on Taxrefund.pro

Many users worry about privacy when entering sensitive financial data.

That’s why taxrefund.pro ensures:

- Encrypted data transmission (SSL security)

- No personal information is stored permanently

- Calculations are based on verified tax data and updated laws

Accuracy and transparency are the foundation of this platform.

- Tax Refund FAQs

Q1: How long does it take to receive a tax refund?

A: In the US, electronic refunds typically arrive within 2–3 weeks. In the UK, HMRC usually processes refunds within 2–5 weeks.

Q2: Is my tax refund taxable?

A: No. Refunds are not considered income; they’re a return of overpaid tax.

Q3: Can I use the calculators if I’m self-employed?

A: Yes, the calculators support various income types — salaried, freelance, and mixed sources.

Q4: What if the calculator result doesn’t match my final refund?

A: The calculators provide an estimate based on your inputs. The final refund depends on official review by the IRS or HMRC.

- Why Choose TaxRefund.pro

Here’s what makes taxrefund.pro stand out:

- Simple, clean interface

- Separate calculators for US and UK taxpayers

- Real-time tax code updates

- Transparent refund breakdown

- 100% free to use

By offering specialized tools for different regions, the platform helps users avoid the one-size-fits-all approach that many generic calculators use.

Multi-Country Tax Support Made Simple

While TaxRefund.pro is designed primarily for users in the United States and the United Kingdom, it also caters to a global audience. The platform is also available for Canada, Australia, Germany, France, and other regions, providing accurate tax calculations that reflect local tax laws, rates, and deductions. Whether you are an expat, freelancer, or international employee, TaxRefund.pro ensures that you can quickly estimate your refund or tax liability no matter where you live.

Accurate and Region-Specific Calculations

TaxRefund.pro doesn’t rely on generic tax rules. Instead, it uses region-specific data to calculate refunds and taxes with precision. For the U.S., it accounts for federal and state tax brackets, deductions, and filing status. For the UK, it mirrors HMRC rules including PAYE deductions and personal allowances. Other supported countries are similarly customized, allowing users to see exact refunds or obligations without confusion or guesswork.

Supporting Freelancers and Remote Workers Globally

Many global professionals, freelancers, and remote workers struggle with understanding their tax obligations across countries. TaxRefund.pro solves this problem by offering multi-country calculators that factor in diverse income sources, deductions, and regional tax brackets. Users can plan quarterly tax payments, avoid overpayments, and make informed financial decisions whether they are in North America, Europe, or Australia.

Streamlined Financial Planning Across Borders

With TaxRefund.pro, financial planning becomes effortless for anyone earning in multiple jurisdictions. By comparing potential refunds or tax liabilities in different countries, users can forecast take-home pay, adjust withholding, and optimize deductions. This global functionality ensures that professionals moving between the U.S., UK, Canada, or other supported regions can manage their finances efficiently without needing separate tools for each country.

A Single Platform for Global Tax Efficiency

TaxRefund.pro combines ease of use, accuracy, and global reach in one platform. Users no longer need multiple spreadsheets or region-specific apps to calculate refunds. Whether you are filing in the U.S., UK, or any of the additional supported countries, you can rely on TaxRefund.pro to provide fast, accurate, and compliant calculations, helping both individuals and businesses maximize refunds and maintain transparency in financial planning.

- Final Thoughts

Understanding taxes doesn’t have to be overwhelming. With the right knowledge and tools, you can turn a complex process into a clear path toward reclaiming your money.

Whether you’re a US employee checking your federal refund or a UK resident exploring PAYE overpayments, taxrefund.pro provides the clarity and accuracy you need.

Try it today:

- US tax refund calculator

- UK tax refund calculator

Get your refund estimate instantly — and take control of your finances with confidence.