As work and investment become more borderless in the world, the operation of various tax systems has never been that important. As a freelancer who works now remotely, a dual citizen trying to manage his income across the border or as someone interested in an overview of how the U.S. and the U.K do their taxes, this guide disaggregates the information you need to know about the taxation in the U.S. and the United Kingdom in 2024-25.

We will discuss how each system functions, the changes in the same regard, and the comparison of the two in practice.

Understanding US Taxes

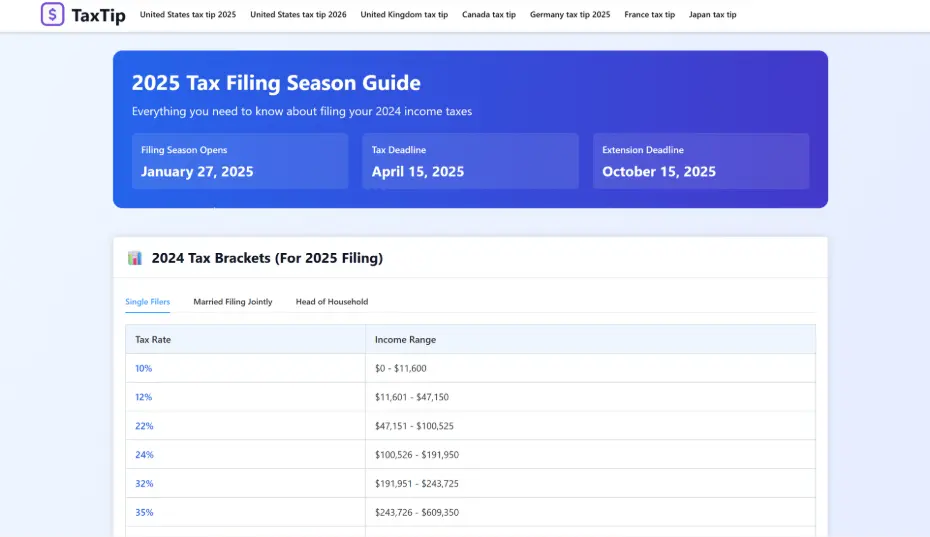

The United States has a progressive system of income taxation- that is, the higher the income a person receives, the higher the rate he or she pays on each extra dollar. Your tax rate depends upon what you make by way of taxable income and that is the total income shown less the deductions, credits, and exemptions

Federal Income Tax Brackets for 2024

In the forthcoming tax year 2024, the tax brackets of seven are 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent and 37 percent. These are applicable to various taxable income levels and differ according to your filing status which may include: single, married filing jointly, married filing separately and head of household.

For example, single filers pay:

● 10% on income up to around $11,000

● 12% on income between roughly $11,000 and $44,000

● 22% on income up to about $95,000

● And so on, until the top rate of 37% applies to income over roughly $578,000

Married couples filing jointly roughly double these thresholds, paying 10% up to about $22,000 and hitting the top rate above about $693,000.

The Standard Deduction

The standard deduction is one of the largest aspects of the U.S. tax system: it is a deduction amount that decreases your taxable income. In the case of 2024, it is 14 600 to single filers and 29 200 to the married couple that files jointly.

The reason why most taxpayers claim the standard deduction rather than the itemization of the expenses is that it is easier and can have a lot of benefits unless you have huge expenses that can be claimed as deductible like the mortgage interest or medical bills

Payroll and Other Federal Taxes

Income tax isn’t the only federal tax Americans pay. There are also payroll taxes, which fund Social Security and Medicare. These are split between employee and employer:

● 6.2% each for Social Security, up to a certain income limit

● 1.45% each for Medicare, with an extra 0.9% surtax for higher earners

In addition, there are taxes on investments (capital gains), estates, and gifts, each with its own rules and thresholds.

Worldwide Income and Residency Rules

One of the significant distinctions between the U.S. and most other nations is that the citizens and permanent residents of the U.S. pay taxes on their global income regardless of their places of residence. This is to imply that despite living in another country, you still have to prepare a U.S. tax filing annually. The U.S. however, provides credits and exemptions that would avoid double taxation including the Foreign Earned Income Exclusion.

The Broader Picture

The tax brackets have been moving upwards in recent years by inflation adjustments, which have made the tax burden marginally lower in the case of most individuals. The various deductions and credits are however phased out at higher income levels such that richer taxpayers are not as much benefiting by them.

State income taxes are part of the U.S. system that may reach 0 in such states as Florida or Texas or above 13 percent in California. The site of your residence in the U.S. can be a significant difference in your overall tax bill.

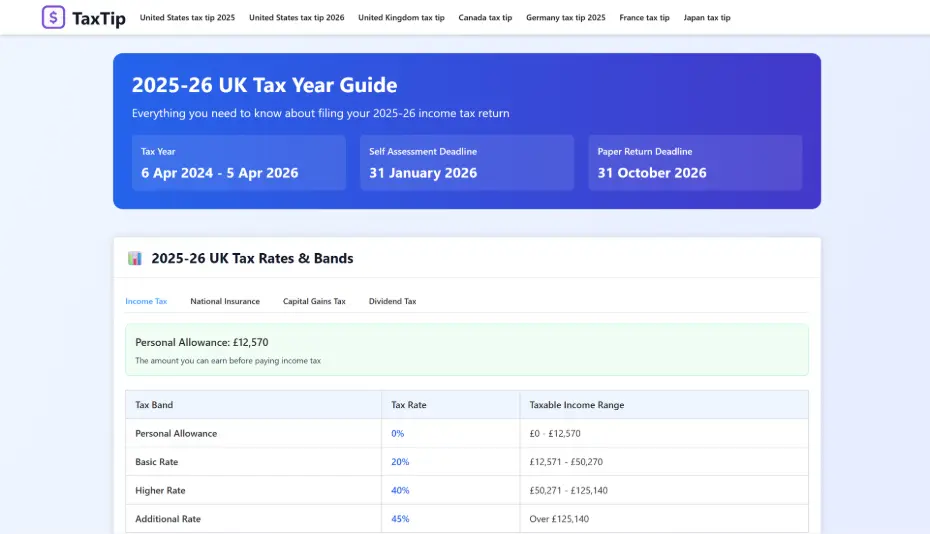

The UK Tax System for 2024-25

UK tax rates 2024-25, which is across the Atlantic, there is a progressive tax system similar to that of the United States of America, though the specifics differ significantly. The UK tax year is between 6 April 2024 and 5 April 2025 and employees raise their income tax using the PAYE (Pay As You Earn) system, as the self-employed pay their income tax through their own returns.

Income Tax Bands and Rates

In England, Wales, and Northern Ireland, there are three main income tax bands for 2024-25:

● Basic rate (20%) – on income between £12,571 and £50,270

● Higher rate (40%) – on income between £50,271 and £125,140

● Additional rate (45%) – on income above £125,140

Everyone also gets a Personal Allowance — the amount you can earn before paying income tax — which is set at £12,570.

However, once your income exceeds £100,000, this allowance is gradually reduced by £1 for every £2 of income above that threshold. By £125,140, the allowance is completely gone, meaning those earning above that level face an effective marginal rate higher than the headline 40%.

Dividends, Savings, and Allowances

The UK also taxes different types of income at different rates. Dividend income has its own lower rates — 8.75%, 33.75%, and 39.35% — depending on your tax band. There’s also a small Dividend Allowance, allowing you to earn a set amount in dividends before tax.

For savings interest, many people benefit from the Personal Savings Allowance, which lets basic-rate taxpayers earn up to £1,000 of interest tax-free (£500 for higher-rate taxpayers).

National Insurance Contributions

On top of income tax, UK employees and employers pay National Insurance Contributions (NICs), which fund state benefits such as pensions, unemployment, and healthcare. Employees generally pay 8% to 10% on earnings above a certain threshold, while employers pay around 13.8%.

Self-employed individuals pay Class 2 and Class 4 NICs based on their profits.

Regional Differences: Scotland and Wales

It’s worth noting that Scotland sets its own income tax rates and bands for earned income, often with more brackets than the rest of the UK. For 2024-25, Scottish taxpayers pay different rates ranging from 19% up to 48% depending on income level. Wales, meanwhile, has the power to vary rates slightly, though it currently aligns closely with England.

The “Fiscal Drag” Effect

Although the UK’s tax rates haven’t increased, the government has frozen the main thresholds — the Personal Allowance and basic-rate limit — until 2028. As wages rise with inflation, more people are pulled into higher tax bands, even if their purchasing power hasn’t changed. This silent rise in tax is often called “fiscal drag.”

Comparing the US and UK Systems

While both countries use progressive tax structures, there are key differences in how they treat income, allowances, and residents.

Feature |

United States |

United Kingdom |

Tax Year |

Calendar year (Jan–Dec) |

6 April–5 April |

Top Rate |

37% (federal only) |

45% |

Personal Allowance / Deduction |

$14,600 (single) |

£12,570 |

Worldwide Income |

Taxed for citizens & residents |

Only UK-source (unless resident) |

Payroll / Social Tax |

Social Security & Medicare |

National Insurance |

Local/State Taxes |

Vary widely by state |

Minimal local taxes (Council Tax is separate) |

In the United States, taxpayers tend to have state taxes on top of an already complicated situation, whereas UK taxpayers have a more homogeneous system, albeit with some regional variations.

The U.S. system is more prone to provide more credits (as the Child Tax Credit, Earned Income Credit and education credits), on the other hand, the UK system has allowances and tax free bands rather than refundable credits.

The other significant difference is found in filing. In America, a federal tax filing is required by nearly every individual. In the UK, it is not common because the employees have their taxes taken automatically under the PAYE system unless they are self-employed or other complex sources of income.

Key Takeaways for 2024-25

1. Inflation adjustments in the U.S. slightly raise the tax brackets and deductions for 2024, offering mild relief.

2. Frozen thresholds in the UK mean more people will pay higher rates even without earning more in real terms.

3. Both countries continue to rely heavily on income tax for government revenue, alongside payroll contributions.

4. For anyone with cross-border income or residency ties, double taxation treaties between the U.S. and UK can help prevent being taxed twice on the same income — but navigating them can be complex and often requires professional advice.

Final Thoughts

TheUS taxes as well as the UK tax rates in 2024-25 are both reflective of a compromise between progress and realistic in the real world, though they also demonstrate how economic policy and inflation can be applied in the real world.

It can make a difference to American taxpayers, who are to keep in mind the presence of inflation-linked deductions and the presence of state taxes. The frozen allowances apply to the UK taxpayer and even a small increase in pay may result in higher brackets to the taxpayer effectively decreasing the take-home pay.

You could be comparing these systems to work, study or to invest and regardless of your reasons to do so, having knowledge of how each of them works can help you make better financial decisions and you may not incur severe shocks come tax time.