The first step towards personal finance management is to have a clear picture of the precise amount of money you get at the end of the payday after taxes, deductions, and other withholdings. It is essential to know your net pay whether negotiating a new employment position, comparing wages across the states or merely planning your monthly budget.

To most career people, it is often difficult to determine take-home pay because of the complicated tax laws, state regulations, as well as different kinds of deductions. And this is where PayCalculator.ai US salary calculator comes in the picture as a sophisticated online application that aims at ensuring that your calculations of the salary are correct, quicker, and worry-free.

Why You Need a Salary Calculator in the US

The majority of the employees have a huge gap between what they earn in terms of gross salary and what gets to their bank account. The disparity is due to taxes, insurance payments, pension savings, and other deductions. The problem is that manual calculations may cause some errors and misunderstandings.

A salary calculator will give you a clear accurate picture of what your actual income will appear like once all deductions have been made. It helps you understand:

- How much you’ll earn monthly or weekly after tax

- How federal and state taxes impact your pay

- What difference benefits and deductions make

- How salary changes or job offers will affect your finances

With a reliable online tool like PayCalculator.ai, you can save hours of guesswork and get transparent results instantly.

Introducing PayCalculator.ai

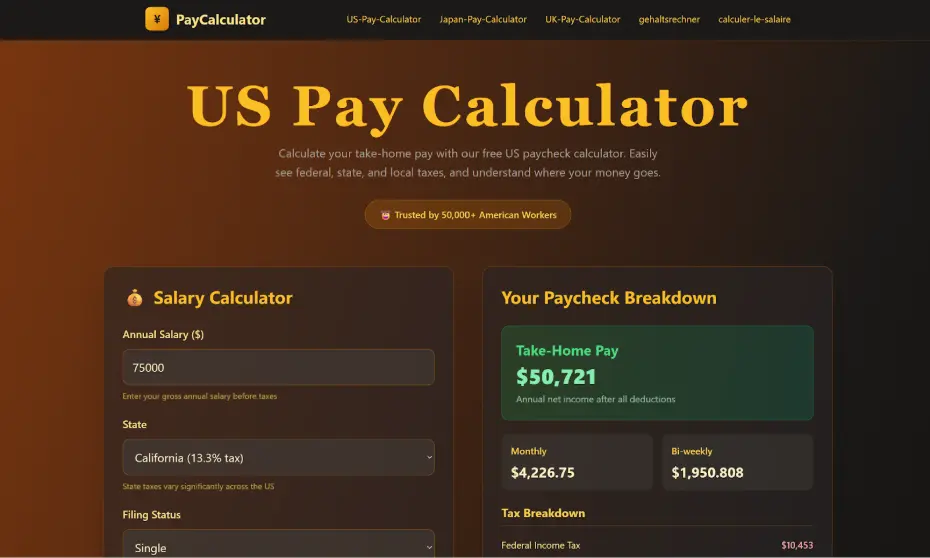

PayCalculator.ai is a user-friendly app that is aimed at showing an American employee how much they actually earn, after taking home. It is also specifically designed to work with the U.S. tax system, unlike most generic calculators, so that not only the federal deductions are computed in the correct way, but also the state ones.

The tool is available to all people, including a full-time worker, freelancer, contractor, and an HR specialist. It is easy to do complicated computations because of its convenient interface and clever backend.

This is what is special about PayCalculator.ai:

- Real-time Accuracy – Updated with the latest U.S. tax rates and laws to reflect true deductions.

- State-specific Results – Calculates salary differences based on the state you live or work in.

- Multiple Pay Frequencies – Choose between annual, monthly, biweekly, or weekly pay to see how your paycheck breaks down.

- Deductions Transparency – Shows every part of your pay structure — from gross salary to federal, state, and FICA taxes.

- Instant Comparisons – Easily compare salaries between states or job offers.

How the Net Pay Calculator Works

The net pay calculator is simple yet powerful. You just enter basic details such as your gross salary, state, filing status, and pay frequency. Within seconds, it provides a full breakdown of your paycheck — including take-home pay, total tax amount, and employer contributions.

Here’s an example of what it can calculate for you:

- Gross Annual Salary: $80,000

- State: California

- Filing Status: Single

- Pay Frequency: Monthly

After entering these details, you’ll instantly see your federal and state tax deductions, FICA contributions (Social Security and Medicare), and final net pay. The tool also adapts to current tax brackets, ensuring that results are precise and compliant with the latest tax year.

Benefits of Using PayCalculator.ai

1. Simplifies Complex Tax Calculations

U.S. tax laws can be challenging, especially when different states have different rules. PayCalculator.ai simplifies all that complexity, letting you see the final number you care about most — your take-home pay.

2. Helps You Plan Financially

Understanding your true earnings allows for smarter budgeting. You can easily estimate how much to allocate toward rent, bills, savings, or investments.

3. Useful for Job Negotiations

When you’re switching jobs or evaluating offers, gross salary numbers can be misleading. Using the US salary calculator ensures you know what your actual paycheck will look like, so you can negotiate with confidence.

4. Ideal for Freelancers and Contractors

Independent workers often need to set aside their own taxes. The tool gives a clear picture of how much you’ll owe, helping you plan quarterly tax payments and avoid year-end surprises.

5. Quick, Accurate, and Free

PayCalculator.ai doesn’t require sign-ups or complex inputs. In just a few clicks, you’ll get the information you need — accurately and instantly.

How It Helps Employers and HR Professionals

This tool isn’t only for employees. Employers, HR managers, and recruiters also use PayCalculator.ai to estimate employee compensation packages. By calculating take-home pay before making an offer, companies can ensure transparency and improve trust with potential hires.

Moreover, HR professionals can use the net pay calculator to create detailed salary reports and forecast payroll budgets more effectively.

Comparing Salaries Across States

The ability of PayCalculator.ai to compare take-home pay in different states is one of the distinct benefits of this instrument. Tax rates and deductions are also highly differentiated in the U.S. and hence your net pay might vary by a large margin even with a constant gross income.

As an example, an 80000 salary in Texas (no state income tax) will translate to increased take-home pay as compared to the same salary in California or New York. You can easily learn more about these differences and make well-informed decisions regarding relocation or remote employment with PayCalculator.ai.

Financial Awareness Starts with Knowledge

Most people only check their paycheck balance without understanding how much goes toward taxes or deductions. But with tools like PayCalculator.ai, financial awareness becomes simple. You can see exactly where your money goes, how much you’re paying in taxes, and what portion you can actually spend or save.

This kind of insight is essential for:

- Budgeting effectively

- Avoiding financial surprises

- Planning savings and retirement

- Preparing for life events like marriage, relocation, or home buying

Why PayCalculator.ai is Different from Other Tools

While there are several salary calculators online, many lack precision, don’t account for state taxes, or use outdated data. PayCalculator.ai sets itself apart by focusing on:

- Accuracy – Always updated with the newest tax brackets.

- Speed – Delivers results instantly without unnecessary steps.

- User Experience – Minimal design, mobile-friendly, and intuitive.

- Reliability – Trusted by professionals for accurate pay insights.

Whether you’re checking your paycheck or comparing job offers, PayCalculator.ai provides real, actionable data in seconds.

Global Tax Calculations Made Easy with PayCalculator.ai

PayCalculator.ai is designed primarily for U.S. users, offering an accurate US salary calculator that accounts for federal and state tax rates, deductions, and filing statuses. However, its capabilities extend beyond the U.S., making it a versatile tool for a global audience.\

The platform is also available for users in Canada, the United Kingdom, Australia, Germany, and France, providing region-specific calculations that reflect local tax laws and rates. With PayCalculator.ai, individuals and professionals worldwide can efficiently compute their net income, understand how taxes impact their take-home pay, and make informed financial decisions — all from a single, user-friendly interface

Take Control of Your Finances Today

How to understand your pay is not only about the numbers but also making the right decisions. Career planning, budgeting, savings, all of this starts with how much money you are actually earning.

Whether you are using the US salary calculator or net pay calculator at PayCalculator.ai, you can avoid making guesses and be comfortable with managing your finances.

Whether you are an employee, freelancer or an HR manager, this smart site will give you clarity on how to better manage your income and plan on how to manage in the future.

Final Thoughts

How to understand your pay is not only about the numbers but also making the right decisions. Career planning, budgeting, savings, all of this starts with how much money you are actually earning.

Whether you are using the US salary calculator or net pay calculator at PayCalculator.ai, you can avoid making guesses and be comfortable with managing your finances.

Whether you are an employee, freelancer or an HR manager, this smart site will give you clarity on how to better manage your income and plan on how to manage in the future.